Robinhood's options trading revenue grew 298% in 2020, relative to 2019, as the pandemic and government stimulus checks led to a boom in stock market trading by retail investors. In 2020, Robinhood generated $958 million in revenue, of which 46%, or $440 million, was derived from options trading.

#Robinhood app options trading drivers

The document revealed the underlying drivers of Robinhood's business, from options, equities, and crypto trading, to securities lending and payment for order flow.

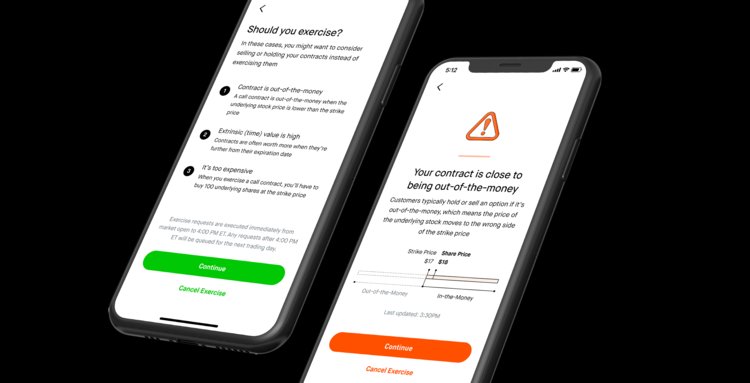

On Thursday, Robinhood filed its S-1 with the SEC, a necessary step the company has to take prior to going public. The comments from Warren Buffett's right-hand man came in an interview with CNBC on Tuesday night, in which the billionaire investor said, "it's telling people they aren't paying commissions when the commissions are simply disguised in the trading." Just two days after Charlie Munger of Berkshire Hathaway called Robinhood "a gambling parlor," the free-trading app said it derives a majority of its revenue from options trading.

Vladimir Tenev and Baiju Bhatt (co-founders) had previous experience building these systems and saw the extraneous costs as little more than gatekeeping people out of investing.

They also needed to invest a minimum of 500 to open an account. Warren Buffett, CEO of Berkshire Hathaway, and vice chairman Charlie Munger. Before Robinhood, anyone who wanted to invest in stocks would be charged between 5 to 10 a trade.

0 kommentar(er)

0 kommentar(er)